Author

Fair winds and following seas unlikely post COP26

Posted by Luuk Jacobs on 28 October 2021

The HM Treasury recently announced that around 70% of the UK public want their money to go towards making a positive difference to people or the planet. This makes a very compelling case for ESG, the most urgent and high profile of which is the environment.

The current challenges will be floodlit by the scrutiny of eyes around the planet on the COP26 (Conference Of the Parties) on climate change next week. There is optimism this will result in tangible commitments and actions on climate change.

The investment management industry has been working hard over the years on the hearts and minds of the investors and launched many new ESG funds. With the first regulations being implemented and a likely waterfall still to come, the industry needs to move to designing and implementing of their operating models that fully incorporate ESG, from decision making, to compliance, performance analysis, client reporting and so on. What does an ESG roadmap need to incorporate?

Expediting Commitments to Climate

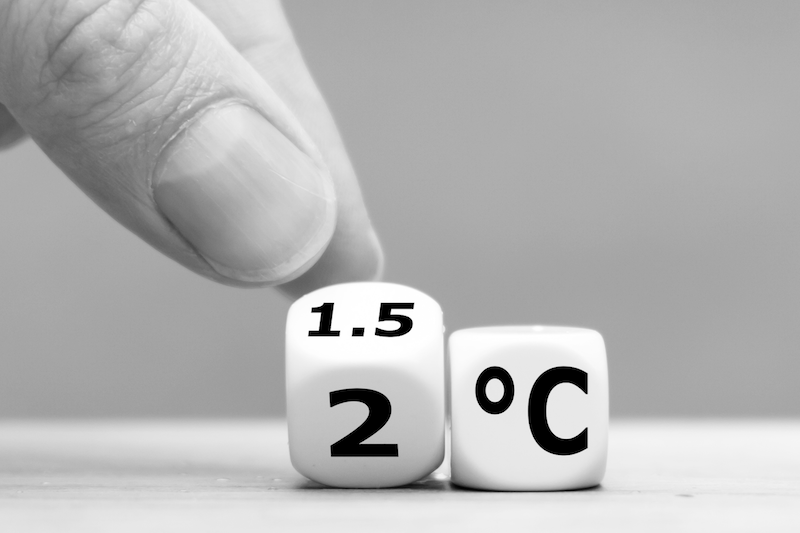

Governments, civil society and companies have all made commitments to accelerate action towards the Paris Agreement (COP21) goals and the UN Framework Convention on Climate Change to ensure that global warming will be limited to well below 2.0°, preferably to 1.5°, compared to pre-industrial levels. Equally COP26 seeks countries to adapt in order to protect communities and natural habitats and mobilise an agreed $100bn in climate finance a year.

However, there is a new sense of urgency. According to the Intergovernmental Panel on Climate Change in its Sixth Assessment Report, there is insufficient pace of climate action to date and without rapid and drastic reductions in emissions this decade, we will fail to deliver the promise of the Paris Agreement.

Based on this assessment the COP26 Presidency, the COP26 Private Finance Hub and the High-Level Climate Action Champions are therefore calling for private finance institutions to make clear commitments for COP through their areas of focus:

- Credibly commit to net zero by joining the relevant Race to Zero alliance within the Glasgow Financial Alliance for Net Zero (GFANZ).

- New finance in developing countries and emerging markets for net zero alignment and adaptation.

- Coal phase out

- Nature-positive finance

These are tall orders. How can the investment industry deliver on these objectives?

Delivering ESG with integrity: Regulation

How should the investment industry play its role in fulfilling these commitments and mitigating the global climate challenge? Due to a lacking framework of regulation, insufficient reliable and consistent data and operational infrastructure and/or not being able to justify ESG credentials in funds or even names of funds, this is no easy feat for the Investment industry to deliver upon, without falling into the traps of ESG greenwashing. Ahead of future regulation, the FCA has published this summer “guiding principles on design, delivery and disclosure of ESG and sustainable investment funds” in a letter to the Chair of Authorised Fund Managers.

Despite the many things that cannot be measured the Investment industry has been managing, actively discussing and making progress on ESG in general and specifically climate change, to start delivering on the Paris agreement. However powerful regulation and policy development remains key, and this has only progressed in the last couple of years with the EU at the forefront.

This means there are still many hurdles before full integration of ESG within the Investment management process is possible and embedded to a level where it is well understood within the companies and by the Investors, which is a key condition to mitigate and avoid any potential reputational and legal risk of potential green washing.

Green Governance

One of the main hurdles is robustness of data; this can be achieved by adopting a clear corporate climate reporting standard and a taxonomy of company economic activities and associated ESG credentials.

There is work to be done here and the creation of global reporting standards is of utmost importance to ensure:

- greater transparency and consistency

- to address other environmental, social and governance issues

- to channel capital to more sustainable asset classes and activities

- meeting ESG disclosure requirements such as the EU’s Sustainable Finance Disclosure Regulation

The International Financial Reporting Standards (IFRS) Board is currently putting the finishing touches to a new International Sustainability Standards Board (ISSB), designed to hold the same reporting standards as those of IFRS. The IFRS is also having regular dialogue with policymakers in the US and the European Commission over the creation of these standards[1].

The ISSB standards are intended to complement the work already being done by the EU and UK to improve company ESG reporting through the EU Corporate Sustainability Reporting Directive (CSRD)[2], which is due to come into force in 2024 (i.e., covering financial year 2023). In addition to the IFRS’s emphasis on financial metrics, the EU standards put an emphasis on the environmental or social impact of a company’s economic activities.

As published in October 2021 through the UK Treasury Green Finance roadmap, the UK sustainable finance regulation will (initially) substantially follow on the EU rules and aims to ensure the financial sector is equipped to play its part; Aligning the financial system with a sustainable future will bring real benefits for the environment and society.

With the help of technology, hopefully we will establish and embed sustainability reporting standards quicker than the 20 years or so it took to have IFRS developed and embedded.

Navigating the uncertainty and change

The big question for firms in the investment management industry is how to navigate all this uncertainty over years while the market and investors are demanding more clarification, transparency and accountability of ESG criteria being incorporated in the management of their portfolios.

At AlgoMe Consulting we believe it is critical for investment management firms who are integrating ESG, to ensure that they create their own net zero transition roadmap for the ESG investment portfolios managed. In the end not so different from the demand the industry puts on the companies it invests in.

The start of such a roadmap should be a clear Company’s purpose and ESG ambition for the next 3-5-10 years. Where the current regulatory (reporting) environment is being developed and likely remain ambiguous for some time, companies should not just ensure alignment with those developments. Equally they should ensure that claimed ESG credentials can be backed up by the internal data and set up of the operational infrastructure to manage and report on these data and ensure consistency, quality, and transparency. Otherwise ESG credentials could not just lead to green washing but to longer term reputational damage and potentially even litigation[3].

Delivering on commitments made

Looking at these questions at industry level, the investment industry needs to go beyond the heads and minds discussion and define how the industry as a whole and the companies individually are going to integrate the regulatory, stakeholder and investors demands within the operational set up of their organisations and systems.

If in that way the investment industry can start measuring and reporting the ESG impact it makes within its managed portfolios, it will be better equipped to deliver on the ESG, and climate targets set as part of the Paris agreement and the areas of focus of COP26.

It is unlikely going to be fair winds and following seas and “ten years from now we will be more disappointed by the things that we didn’t do than by the ones we did do. So, we need to throw off the bowlines. Sail away from the safe harbour. Catch the trade winds in the sails. Explore. Dream. Discover.” [4]

The company that will not sail till all dangers are over, must never put to sea.

[1] Mr White, IFRS Founding executive director, speaking at an October 2021 event organised by the UK Sustainable Investment Forum.

[2] As a follow up on the Non-Financial Reporting Directive (NFRD) of 2014

[3] As published by the Climate Financial Risk Forum, a cross-industry group chaired by the Financial Conduct Authority and the Prudential Regulation Authority, “Disclosures – Managing legal risk”, October 2021

[4] Mark Twain

Next post

Coffee With… AlgoMe Consulting podcast – Has the wave of changes passed its peak in the Investment Industry?

Posted by Pierre-Yves Rahari on 16 November 2021

Read post