Author

The best of the Coffee With… AlgoMe Consulting podcasts

Posted by chris.new@algome.com on 28 February 2022

As we hit a milestone of 1000 downloads, it’s a great time to share our favourite moments with our podcast guests. You can subscribe to our podcast on Spotify and iTunes if you want to catch up with future and previous episodes too.

Operational resilience, with Edith Magyarics and Mike Tumilty

Operational resilience has made the headlines in the Wealth and Asset management industry, with a strong push from the regulators across the UK and Europe (DORA). We discussed the many angles with Edith Magyarics, Chief Executive Officer, Victor Buck Services, and Mike Tumilty, Global Chief Operating Officer, Abrdn. They shared their views of working within an international environment and their experience with real events that can threaten not just the service to the client but equally the existence of a company.

What stood out was mentioned by Mike Tumilty, that operational resilience has become as important as financial resilience, but that we need to look at it holistically and think about business continuity. We need to look at cyber and, importantly, the operation of your business-critical process. Within that review Mike was very clear in that what “operational resilience has at its heart is people”.

Edith Magyarics added that as we have been living through the pandemic, people have been (and still are) working remotely means that you need to be closer to them. It may seem strange because obviously you’re not having the physical proximity, but the management perspective and the management role is getting even more important because you need to be close to the people to understand what they’re doing.

Although the people perspective stood out in this discussion, operational resilience was also discussed from the perspective of how operating models are adapting, after having been tested to the limit during the Covid-19 crisis? What are the implications for outsourcing and is there a prevalent model in the industry? How will operational models stand the test of time in an industry that is continuously undergoing change. And in all of this in the end if operational resilience should be seen as a cross-discipline responsibility or just the COO/CRO?

Find out more by listening to the Coffee With… AlgoMe Consulting podcast: bit.ly/CoffeeWithAlgoMeConsulting17

Operational resilience in practice, with Luuk Jacobs and Pierre-Yves Rahari

We later also discussed Operational Resilience through a Q&A session aimed to answer the many practical questions around creating an operational resilient operational framework and the benefits this brings beyond the prevention of harm to clients and financial markets.

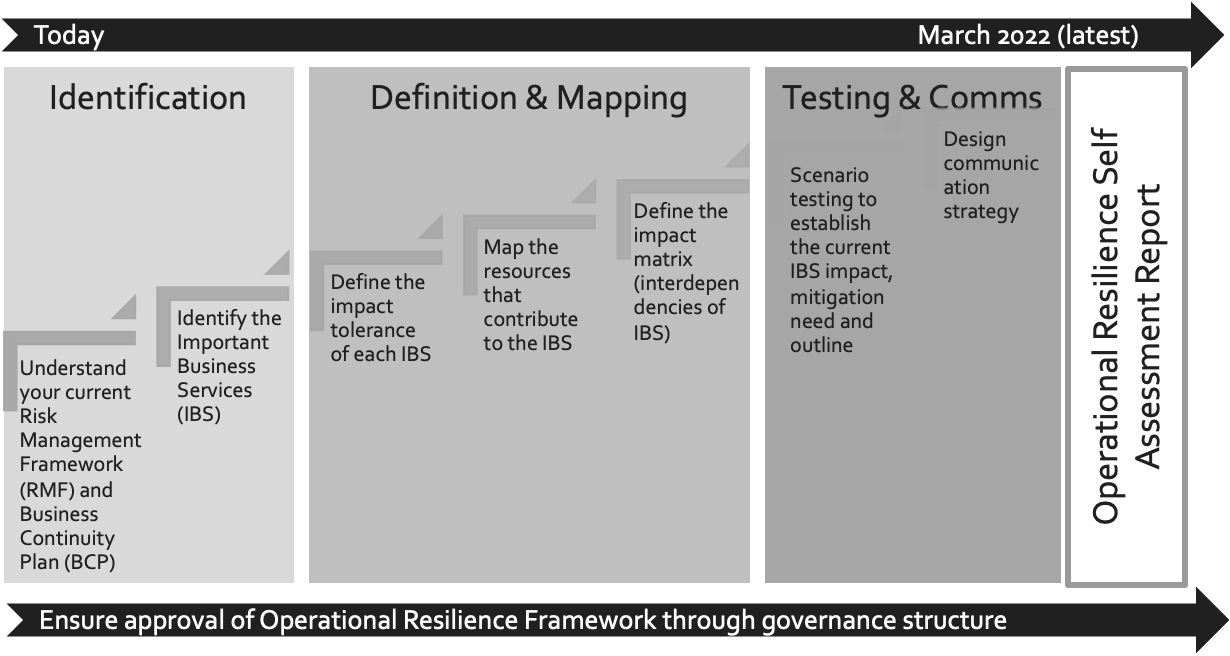

AlgoMe Consulting has created the 7 steps to ensure compliance with Operational Resilience regulation:

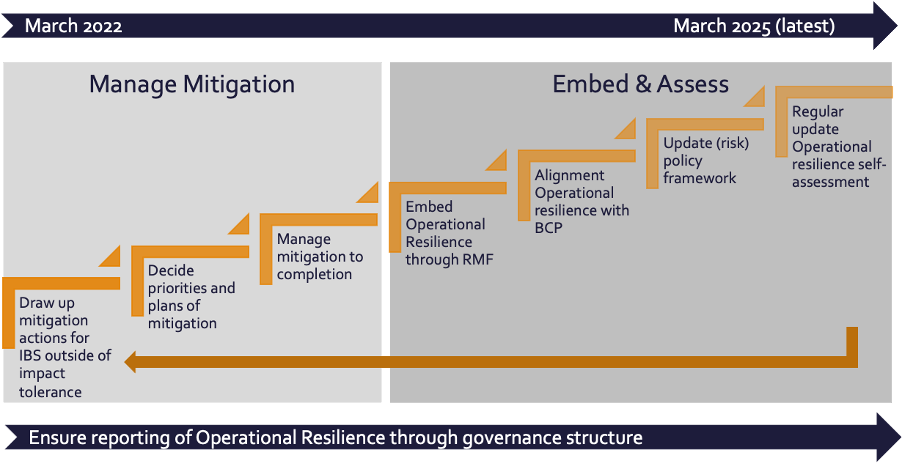

We followed this up with the seven steps of mitigation

Find out more by listening to the Coffee With… AlgoMe Consulting podcast: bit.ly/CoffeeWithAC19

Data and innovation in Investment Management, with Meagen Burnett and Keith Hale

Fintech, AI, Digital Currency and Data, are important subjects in our industry and they can all be a differentiator for an investment manager. Our guests in this podcast Meagen Burnett, Chief Operating Officer, M&G Investments and Keith Hale, Executive Chairman, TrustQuay had some great views on this.

Keith Hale observed that in the investment and wealth and asset management space, the data is so fragmented, not just within companies, but across the industry.

The data will be fragmented across that whole value chain of investments (custodian, fund supermarket, wealth manager, IFA, retail bank, etc). To get a total picture is virtually impossible.

if Facebook or Google or Amazon was setting up an investment product or a long-term savings product, they would not do it like this. They would start with a D to C type model where you would have a direct-to-consumer type process and to be very efficient with great customer experience.

For Meagan Burnett, innovation as a differentiator is largely focused around both the ability to source alternative sources of data and unstructured data and the ability to source, store and interrogate that data. Ultimately in a world where technology is speeding up, the industry needs to be able to deal with more and more data and you can only differentiate yourselves when you have the ability to deal with data better than the guy down the road.

A mesmerising view of where the industry is today and where it (quickly) needs to go to remain relevant and not be challenged by the likes of Facebook, Google, Amazon and/or Apple.

Find out more by listening to the Coffee With… AlgoMe Consulting podcast: bit.ly/CoffeeWithAC18AI

Looking at changes ahead in Investment Management, with Emanuele Ravano and Robin Wigglesworth

And if all of that was not enough we got Emanuele Ravano, Chairman, Uni-Global SICAV Funds, Unigestion and Robin Wigglesworth, Global Finance Correspondent, Financial Times discussing if the wave of changes passed its peak in the Investment Industry.

A fascinating discussion took place around the emergence and “take over” of the Equity passive investment management and the fact that most active investment management has over the long term not been able to deliver better performance results.

A more controversial view on how our industry might develop further was made by Robin saying that he is immensely cynical about ESG and that he feels like a hail Mary from the investment industry that has been unable to perform to the level where they would like compared to the fees that they charge. So, things are wrapped up in green marketing and saying, obviously we can’t be the index, but you can feel good about saving the world.

Looking at what lies ahead of us, Emanuele that with being at an advanced point in the bull market, the next 10 years might be very different with lower returns. Within that climate Emanuele believes that active ETF’s might make more sense.

Another clear point that was made in this podcast was around democratisation of the finance industry. Emanuelle believes that blockchain technology, digital ledger technology, will allow for greater participation in small and mid-sized companies. They are crucial for employment, are crucial for new ideas, and they should not be the domain of just a minority of wealthy investors.

We believe the podcast was absolutely eye opening and providing different and possibly controversial views on the direction of our industry

Find out more by listening to the Coffee With… AlgoMe Consulting podcast: bit.ly/CoffeeWithAC21

Next post

Coffee With… AlgoMe Consulting podcast – Personalisation of investment funds: The next new frontier?

Posted by Pierre-Yves Rahari on 7 March 2022

Read post